DiversyFund CF Venture Investment Opportunity

A venture investment opportunity for all.

DiversyFund CF Venture Investment Opportunity

A venture investment opportunity for all.

A DiversyFund Inc. Walkthrough with Alan Lewis: 15 Minutes

Learn MoreBonus Shares and Investor Perks

Tier

Includes

Tier

Includes

*5% Bonus Shares

Tier

Includes

*10% Bonus Shares

Tier

Includes

*20% Bonus Shares

*Bonus Shares are offered at the sole discretion of DiversyFund and subject to certain terms and conditions.

Growth We’re Proud of:

Diversyfund, Inc. historical stock prices are based on previous issuances of shares to third party investors in private offerings and includes the current share price of its current Regulation CF Offering. There is currently no active market for the shares.

Invest NowOur Mission

DiversyFund, Inc. is on a mission to offer access to private market investment opportunities to everyone, starting with the power of multifamily real estate. This offering is just one more opportunity to invest in potential growth–just like a venture capitalist. By investing in our parent company, you become a part-owner of DiversyFund with us as we work hard to take this company to the next level in the fintech industry.

We’ve combined the potential upside of fintech with the inflation-hedging power of multifamily real estate to create a company primed for future growth in volatile market conditions.

We’ve built a robust online investment platform that makes investing in private market real estate convenient and accessible with low investment minimums. And our industry is just getting started.

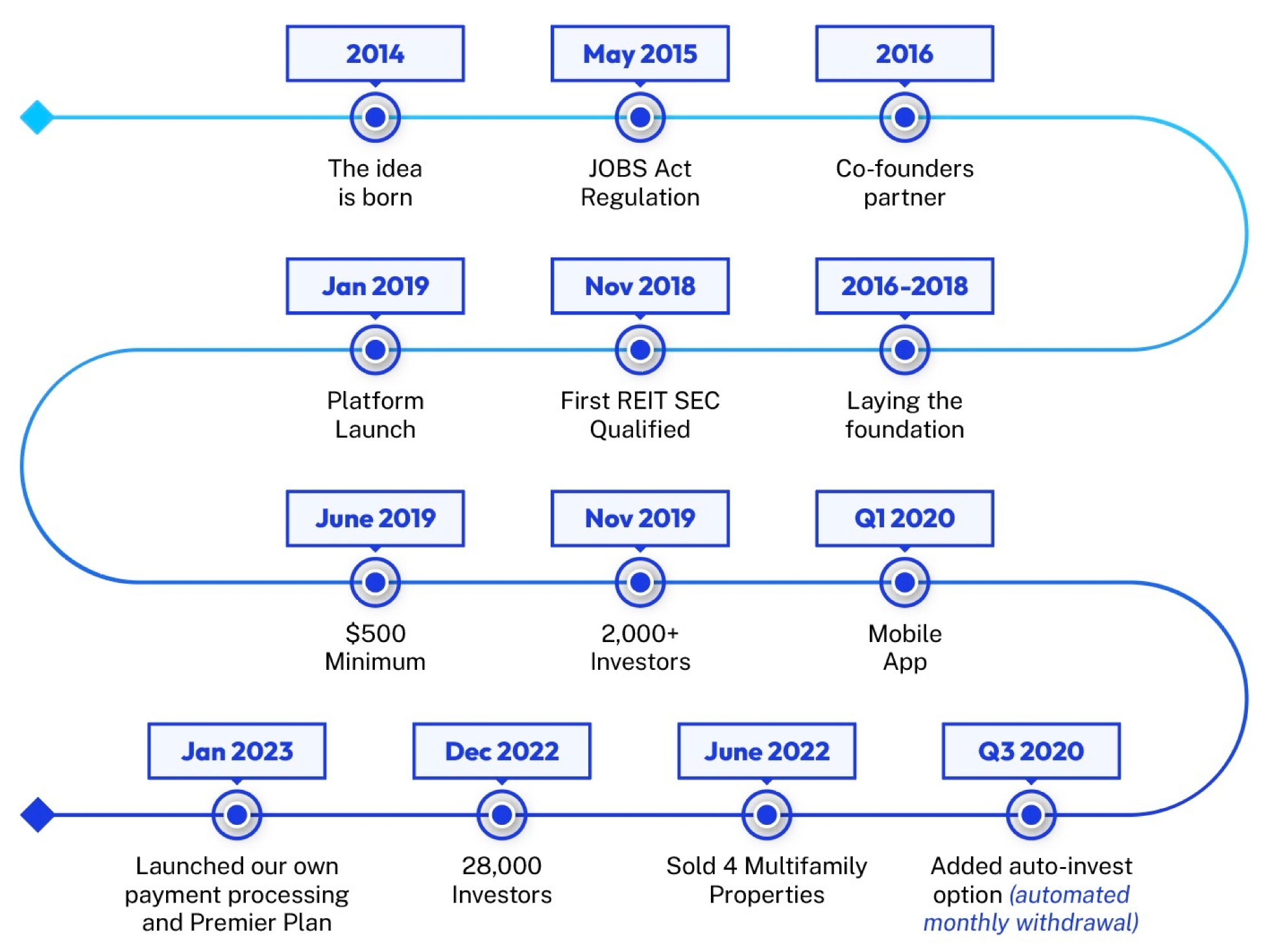

Our Traction

We’ve already crossed some major milestones:

... and we're just getting started.

Invest NowVenture Capital investing can:

Ready to invest in the future?

Invest Now

Frequently Asked Questions

What is Regulation Crowdfunding (Reg CF)?

Regulation Crowdfunding, also known as Reg CF, is an SEC-approved framework that allows eligible companies to raise capital through crowdfunding from a large number of investors. It was introduced under Title III of the JOBS Act and provides an opportunity for non accredited investors to invest in early-stage companies.

Who can invest in Regulation Crowdfunding offerings?

Any individual, over the age of 18, regardless of their income or net worth, can invest in Regulation Crowdfunding offerings. Prior to the passage of the JOBS Act, only accredited investors were allowed to participate in private investments.

What are the investment limits for Regulation Crowdfunding?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater.

For individual non-accredited investors with an annual income or net worth below $124,000, the investment limit is the greater of $2,500 or 5% of the lesser of their annual income or net worth. For investors with an annual income or net worth equal to or greater than $124,000, the investment limit is 10% of the lesser of their annual income or net worth, up to a maximum of $124,000. For more info, see this SEC bulletin.

What is the minimum investment amount for DiversyFund CF Venture Investment?

$550

Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise - you are buying a piece of a company and helping it grow.

What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

What do I need to know about early-stage investing? Are these investments risky?

Yes. All investments carry some degree of risk and startup and small business investing are riskier investments than investing in large, well established companies. The earlier you get in, the greater the level of risk. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait five to seven years (or longer) for an exit via acquisition, IPO, etc. The company may never achieve an exit. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should make up only a part of a balanced investment portfolio.

When will I get my investment back?

The Common Stock (the "Shares") of DiversyFund, Inc. (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Can I sell my shares?

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

1. Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

What happens if the company does not reach its funding target?

How can I learn more about a company's offering?

What if I change my mind about investing?

How do I keep up with how the company is doing?

What relationship does the company have with DealMaker Securities?

Join the Discussion